Berwin Leighton Paisner's merger talks with Greenberg Traurig have collapsed because the US firm wanted its board to have total control over how much BLP partners were paid.

News of the discussions were revealed last month and the deal looked like it might have some legs. Both firms are well known in their domestic markets but largely unknown outside them, and a merger would have brought a solid presence for each in large markets. There were differences in size (GT has 1,800 lawyers compared to BLP's 700) and profitability (GT has PEP of $1.42m as opposed to BLP's $1.09m), but they are problems that generally plague UK/US mergers and insiders tell RollOnFriday they were surmountable. The real sticking point was the basis for partner remuneration.

Most UK-headquartered firms (including BLP) operate on a modified lockstep basis, under which partners' remuneration is decided to a significant degree by how long they have worked as a partner. Not so GT, which uses the ominously-named "black box" system. The firm's executive committee decides in its absolute discretion how much each partner gets paid. And it wanted to extend this mechanic across the merged firm. One can see why BLP's London partners would be less than delighted at having their remuneration set entirely at the whim of a handful of partners in Miami whom they'd never met:

Hiram Humpengrind III: "Next up is Joe Blogs, employment partner in London. Anyone know him? Anyone?"

Trey Butkiss Jr: "Never heard of him Mr Humpengrind."

HH: "He was on $1.2m last year. That seems like a lot. What is employment law anyway? Can't these people just fire at will like we do?"

TB: "Europe is crying out for a Donald Trump Mr Humpengrind."

HH: "Someone told me that Skadden was courting that finance partner we recently made up in New York. Let's bump him up $400k and take it out of this idiot's pocket. Agreed?"

So it's back to the drawing board for BLP. Greenberg Traurig chair Richard Rosenbaum said the US firm had never completed a large merger “because of our basic belief that ‘culture eats strategy for lunch’", and that while BLP offered an "exciting" opportunity to enhance its practices, GT would not merge "at the risk of materially diluting our cultural, financial and other priorities".

Tip Off ROF

News of the discussions were revealed last month and the deal looked like it might have some legs. Both firms are well known in their domestic markets but largely unknown outside them, and a merger would have brought a solid presence for each in large markets. There were differences in size (GT has 1,800 lawyers compared to BLP's 700) and profitability (GT has PEP of $1.42m as opposed to BLP's $1.09m), but they are problems that generally plague UK/US mergers and insiders tell RollOnFriday they were surmountable. The real sticking point was the basis for partner remuneration.

Most UK-headquartered firms (including BLP) operate on a modified lockstep basis, under which partners' remuneration is decided to a significant degree by how long they have worked as a partner. Not so GT, which uses the ominously-named "black box" system. The firm's executive committee decides in its absolute discretion how much each partner gets paid. And it wanted to extend this mechanic across the merged firm. One can see why BLP's London partners would be less than delighted at having their remuneration set entirely at the whim of a handful of partners in Miami whom they'd never met:

Hiram Humpengrind III: "Next up is Joe Blogs, employment partner in London. Anyone know him? Anyone?"

Trey Butkiss Jr: "Never heard of him Mr Humpengrind."

HH: "He was on $1.2m last year. That seems like a lot. What is employment law anyway? Can't these people just fire at will like we do?"

TB: "Europe is crying out for a Donald Trump Mr Humpengrind."

HH: "Someone told me that Skadden was courting that finance partner we recently made up in New York. Let's bump him up $400k and take it out of this idiot's pocket. Agreed?"

|

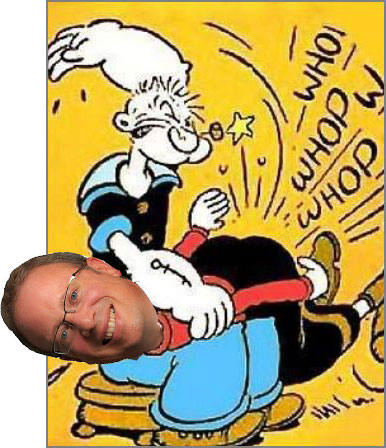

The special relationship. How Neville Eisenberg at BLP saw it. |

|

|

The special relationship. How GT saw it. |

So it's back to the drawing board for BLP. Greenberg Traurig chair Richard Rosenbaum said the US firm had never completed a large merger “because of our basic belief that ‘culture eats strategy for lunch’", and that while BLP offered an "exciting" opportunity to enhance its practices, GT would not merge "at the risk of materially diluting our cultural, financial and other priorities".

Comments

127

135

108

132

123

135

124

143

108

139

What does that mean exactly? Is it like rock-paper-scissors?

124

131

What does that mean exactly? Is it like rock-paper-scissors?

140

134

122

137

101

116

GT largely unknown in London? Their London office Greenberg Traurig Maher has revenue of $50 million dollars a year.