"Piece of cake! This will be easier than stealing candy from a baby," explained Gordon Ruthless, the managing partner of the law firm Macho & Blokes to his fellow partners, 12 angry men who formed an illustrious old boys club and the firm's partnership.

"It will be a prime example of survival of the fittest, the anatomy of a merger."

M&B was the fastest growing law firm in the market. They had an aggressive way of acquiring competitor firms, thinly masquerading them as mergers of equals, buying the morally nonchalant partners of the target firm by throwing signing bonuses and guaranteed takeout promises for the first three years at them, playing those partners against each other, and then striking a deal with the survivors.

These remaining rarely lasted longer than 18 months within the merged firm. Heart attack, burnout, depression and other psychological illnesses worked for M&B, as the small print of the merger agreement linked the guaranteed bonuses to 100% delivery. No work, no guaranteed bonuses.

The partners at M&B adored the power of money, and it normally got the job done. Find the weak spots, the ones approaching retirement age, the ones grappling with performance issues. They were amenable to a deal.

But occasionally, they had to resort to blunter tools to convince recalcitrant partners at law firms they wanted to buy. They called it DDD, the dirt due diligence. For this, they had an army of private investigators screening every voting partner of the target firm for weaknesses. What they were looking for were dirty little secrets. If someone had an extra-marital affair, a weak spot for gambling, alcohol or kinky practices, whether in law or otherwise, had cheated at the bar exam some thirty years ago, or misappropriated firm giveaways or toilet tissues from the firm, they had their ways of finding out. And once they did, you were signed, sealed and delivered, and eventually the deal was done.

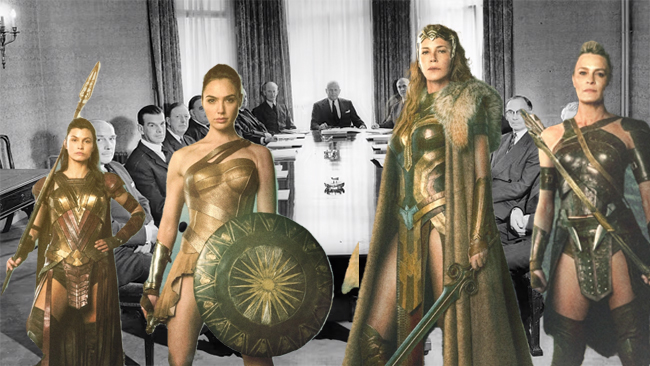

The new target was Mothership Attorneys, a relatively new firm that had tremendous success, an unrivalled reputation as the best place to work at, and lately some media attention for a very particular diversity issue: The firm only had female partners – they called themselves Amazons.

There were eerie but at the same time admiring stories about the atmosphere at the partner meetings, sorry, Amazon meetings. Well-prepared agenda items, unagitated, calm and constructive discussions, no yelling, no ego shows, no showing off, no juicy jokes; some even heard that they were sometimes dancing together, which in the market yielded them the nickname Ten Ladies Dancing.

The managing Amazon was Hyppolita Ferguson. Tall, legally blonde and with a perfectly even Vogue face, she looked as if butter wouldn't melt in her mouth, but as a well-educated, experienced M&A lawyer by education, she was smart, effective and to the point in negotiations, just without the usual testosterone behaviour, and with a relentless focus on the issues that were important for her client. Her specialties were takeover defense and reverse takeovers.

M&B had approached several of the 10 female partners of Mothership Attorneys with their usual "Throw money at them!"-strategy, but none of them would sell her soul. Consequently, they let the private detectives off the leash, just to be disappointed again. No apparent affairs, no alcohol abuse, no illegal gambling. It was as if each of the ten was Mother Theresa. Gordon Ruthless was at a loss and, as always when he did not know how to continue, he called his cousin Vinny.

Vinny said that that the way they were approaching it was aimed too much at old boys lawyers and not at females. So they re-instructed their private detectives to look for covert plastic surgery, cat fights with sisters, eating disorders, mother issues and shopping addictions. First, they again found nothing. But then, they identified one individual Amazon, who was a mother of twins, very anxious and agitated children, who brought their mother to her knees, to the point that she used some of the anti-depressants meant for her children for herself. They had their entry and were now able to force Mothership Attorneys into due diligence and negotiations.

After the first week, the partners of M&B gathered in their conference room to discuss the results of their due diligence. As always, Gordon ran the show tightly.

"Financials?" "Yes, we went through all their books. All in perfect order. Their hourly rates are twenty percent lower than hours, still, their profitability is 20% higher than ours." "How can that be?" "We do not know for sure, but we think it is several factors: They have a client retention rate of 99%. They actually do not lose any clients. The 1% are clients that they terminated because they do not want to work for them anymore. The ones staying refer practically all their work to them."

"Associates are all at 100% utilization. None of them is higher than 110%. They have no significant holiday or overtime entitlements outstanding." "Other factors are that the staff is highly motivated and efficient at work and their absenteeism rate is ridiculously low, which allows them to staff very thinly. "

"Also, they are very focused on invoicing and collections. Their average payment time for an invoice is 45% shorter than ours. This firm is a finance guy's dream!"

A week later, Gordon realized that the two finance partners were missing at the table. He did not think much about it and continued the due diligence reporting exercise: "Human resources!" "Yes, we went through their employment contracts and their statistics. There are some interesting features. The bonus entitlements are not purely discretionary, but partly based on objective key performance indicators and partly discretionary based on a 360-degree assessment. The same applies to all partners." The report continued praising the firm as a model for modern management, with low attrition, high dedication and pride of every employee.

The next week, the employment partners were also missing at the table. Still, Gordon thought it must be the flu that was going around. "Clients!" "They have excellent clients, many of which we had been chasing unsuccessfully for years. We have zero overlap with them as they do not work for any client who does not have a serious ESG agenda with true traction and commitment. Quite impressive."

Another two partners were missing the next week, and another four the week after. In week four, Gordon was sitting alone in the partners' dining room, when the partner who was closest to him entered the room. "Alistair! At least you're here to join me. Sit down." "There's no use me sitting down, as I'm not staying, Gordon. I only came to bid you farewell."

"But why?" "On the face of it we were very successful. But we were empty and unhappy, unable to build and entertain any human relationships. Money is simply not enough, my friend. Goodbye, Gordon."

At the offices of Mothership Attorneys, Hyppolita had her own question for her friend Aello. "But why are we taking on all these partners from M&B?" "Very simple. It was our best defence, and we needed more diversity. Now we have it."

Comments