The release of financial results by the UK's leading law firms has revealed how the virus has clipped wings at the end of an otherwise excellent year.

Allen & Overy managed to drive revenues up 4% to £1.69 billion and Freshfields' swelled 3% to £1.52bn. But Linklaters' revenue was flat with a 0.7% rise, and all three firms recorded drops in profits.

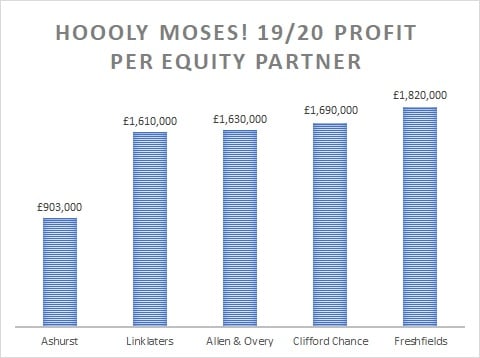

Profit per equity partner slipped, too, but the managing partners won't be resorting to food banks just yet. While profits in the last few months of the 20/21 reporting period were buffeted by the pandemic, the equity partners at Magic Circle firms continued to absolutely rake it in. Just not quite as much as last year. A&O's PEP fell by 1.7% to £1.63 million, Linklaters' dipped just over 5% to £1.61m, and Freshfields fell 1% to £1.82m.

Clifford Chance was the only firm to have bettered its 2018/19 showing on all fronts. The Magic Circle firm's revenues grew by 6% to £1.8bn, its profits increased by 5% to £666m, and PEP rose 5% to £1.69m.

Slaughter and May won't say, but we’ve wagered £2m it’s over £2m.

"Covid-19 came at the tail end of what was a strong year for us", said Linklaters managing partner Gideon Moore. "Notwithstanding the change in circumstances arising as a result of Covid-19, we have been able to continue to support our people and our clients".

Freshfields managing partner Stephan Eilers said his firm had produced a “strong” set of results, “driven by a long-term strategy that has seen us progress despite the challenging economic climate”.

Clifford Chance managing partner Matthew Layton said the firm would focus on remaining "agile and adaptable". He praised Clifford Chance's IT capacity which, he said, "enabled us to embrace the challenge of this enforced global experiment in remote working without any substantive disruption to the high standards that our clients expect from us".

Results have started trickling in from outside the Magic Circle, too, and they paint a similar picture. Last year, Ashurst managing partner Paul Jenkins set a target of pushing PEP to "at least" £1m in 2020, after it soared 31% to £972k in 2018/19.

Covid put paid to that idea, and PEP at Ashurst dropped 7% to £903k. "We were on target to achieve a higher level of growth until late January", said Jenkins, "when markets in Asia Pacific, in which we now generate almost 50% of our revenue, were the first to be disrupted by the pandemic".

Jenkins said its other offices were then impacted as the virus travelled the world, but that Ashurst had "delivered a robust performance despite these challenging market conditions".

Comments

148

223

And to think it was only a few years ago that Links had the highest PEP in the magic circle. How are the Cs going Charlie?

146

224

Hopefully next year they will pay proper bonuses to staff given these results - clearly showing that covid isn't really impacting profitability.

160

233

And I wonder how many of these firms took taxpayers money to furlough staff to protect their profits??

134

222

Except I thought you reported Slaughters were not paying the bulk of partners’ drawings?

135

211

Shoot. We’ve lost £2m.

145

191

Links took no taxpayer money for Furlough

155

196

Profits from not increasing our pay in line with our increase in PQE, freezing our promotions and giving us measly bonuses...

128

209

Bear in mind that firms don't pay salaries, partner pay, bonuses etc out of last year's results, they pay them out of cash flow. So, a great year last year is not particularly relevant when it comes to being able to pay current bills - this money comes from invoices being paid now.

108

219

This is for the financial year ending 5 April - the worst of the crisis had not hit yet. It’s 2021 that’s going to be tough.

149

221

Shocking to see law firms such as Osborne Clarke and Bird & Bird still taking government money to furlough staff when their partners are earning £500k+. They should give back the money so people who really need the money can buy food and pay their rent. Doesn’t look good on the whole of the legal industry.

124

190

Honestly don't know how they're going to afford new watch bands at this rate.

141

194

“Hopefully next year they will pay proper bonuses to staff”

Ah, bless.