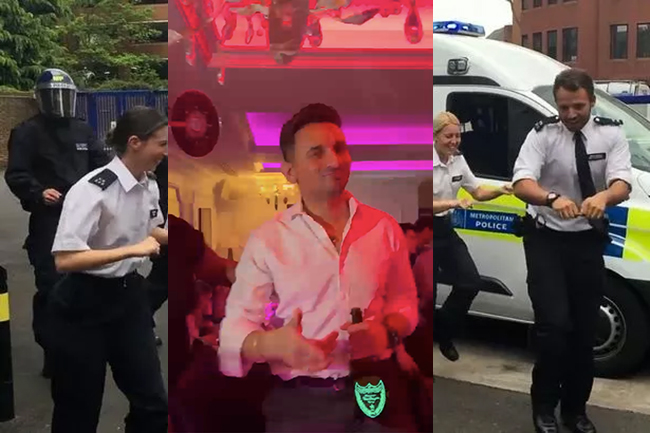

Thanks to the reader who sent another partying Prag pic. More welcome, obviously.

The Serious Fraud Office has arrested seven people in dawn raids as it launches a criminal investigation into the suspected theft of £66m of client money from collapsed law firm Axiom Ince.

Early on Tuesday morning more than 80 SFO investigators and Met police officers bashed doors down at nine locations across the south of England to grab their targets and carry out searches.

The ongoing liberty of Pragnesh Modhwadia, Axiom’s founder and sole shareholder, has left ROF commenters baffled after he admitted spending most of the missing money. However, his lawyer Timur Rustem is reported to have confirmed that Modhwadia was not among the seven, though his home was searched.

"I can confirm that the SFO conducted a search this morning of our client's address," Rustem said in a statement. "Mr Modhwadia was cooperative as he has been from the outset of this investigation."

Axiom Ince fell into administration in October after the SRA closed it down, putting 1,400 jobs at risk, leaving creditors in the lurch and raising the unpopular prospect of a £500 bill for every solicitor in England & Wales.

Members of the profession had demanded to know when the SRA first became suspcicious of Modhwadia, and whether it had permitted him to buy up two much larger firms, Ince Gordon Dadds and Plexus, after it had begun investigating him.

Following the arrests, the SRA addressed its critics by disclosing that its officers were the first to discover something was amiss, and only in July when they visited the firm to review the purchase of Ince Gordon Dadds. A trip was deemed advisable because Axiom was much smaller than Ince and had no experience in shipping law, Ince’s specialism.

The SRA said there had been complaints about Axiom in the past but “nothing out of the ordinary”. The regulator even visited the firm last year when it self-reported a matter relating to its immigration work.

It raises the possibility that, as the firm’s COLP (and COFA, and MLRO), Modhwadia himself called them in and showed them round while sitting on an enormous 'discrepancy'.

In late June, as Modhwadia prepared to celebrate the Ince merger in lavish style by flying staff to London for a huge party, the SRA notified him that it was coming to check over the merger on 25 July.

During its visit SRA forensic investigators “identified the issue of the significant shortage in the client account”, said the SRA.

The nature of the suspected dishonesty “was sophisticated and included falsified bank statements and letters”, and uncovering the scale of the alleged crime took “further digging behind what on the face of it looked like well-ordered accounts”.

Instead of fleeing to a private island with no extradition treaty, Modhwadia pushed back, and documents filed with the court as part of Axiom’s claim against him reveal the lengths to which he allegedly went to disguise the fact that millions – the total is now estimated at £66m – were missing.

He allegedly provided confirmation that a £57 million sum missing from Axiom’s Barclays client account was resting safely in accounts at the State Bank of India, when in fact the SBI had no such client deposit accounts.

Modhwadia is accused of doctoring a letter from the State Bank of India so it falsely showed that it was holding a £57m sum missing from the firm’s Barclays client account. He is alleged to have given the forged letter to Pinsent Masons, which he had instructed to represent Axiom Ince in the SRA investigation, and Pinsents dutifully passed the letter to the regulator.

But at around 6.30am on 4 August, Pinsents partner Samantha Palmer asked one of her firm’s risk managers to catch a train to SBI’s Wolverhampton branch and collect original proof that the bank held the missing money, which was by then suspected of amounting to £64m.

Pinsent Masons’ man arrived at 9.42am, but Modhwadia got there first. He allegedly raced ahead of the firm he had instructed, then provided the branch’s relationship officer with a second forged letter reiterating that SBI still held the missing £57m. It even bore the bank employee’s signature, which must have been confusing for him.

In fact the money had been drained from the SBI after it was transferred, and the SFO has said its investigators will examine how funds got there, and how they were then used to fund Modhwadia’s purchases of Ince, Plexus and a property empire.

Axiom is also suing several property development companies controlled by Modhwadia’s brother, Uttam, whose defence states that he was “raised with the belief that it is important to be loyal to one’s brother”.

Denying all Axiom’s claims, Uttam claims that he “had no understanding as to the nature or significance of a solicitor’s client account and at no material time did he believe, or have reason to believe, that [Modhwadia] had ever misappropriated monies from a client account or otherwise”.

Nick Ephgrave QPM, Director of the Serious Fraud Office, said, “There are a number of significant questions that need to be answered: clients from this law firm are missing many millions of pounds and more than 1,400 of its staff have lost their jobs”, adding that “we have used our specialist powers to obtain important information that will help us get to the bottom of what happened.”

Modhwadia's lawyer did not respond to a request for comment.

Comments

27

18

Great summary RoF. Keep up the reporting.

28

18

Sam Palmers needs to re assess her firm’s KYC and CDD processes. Why are they checking source of funds months after an acquisition. Should have been done at the start.

27

14

Where is the pic of Praggy with the strippers in the club?

29

11

The Serious Fraud Office has arrested seven people in dawn raids

Timur Rustem (Modhwadia's lawyer) is reported to have confirmed that Modhwadia, Axiom’s founder and sole shareholder, was not among the seven, though his home was searched

________________________________________________________________

SFO being as effective as ever,

but I suppose at least we know there are at least 7 innocent people in this mess

29

14

This doesn’t even touch the surface. What about the previous and current Ince finance directors who stole PAYE and Pensions from employees and never paid it to hmrc or the pension pots.

29

15

SUBTITLES FOR THE HARD OF UNDERSTANDING:

The nature of the suspected dishonesty “was sophisticated and included falsified bank statements and letters”

WE NOTICED THAT £57M OF CLIENT MONEY WAS MISSING AND WAS SAID TO BE HELD AT A BANK WHICH DIDN'T OPERATE CLIENT ACCOUNT FACILITIES. WE DIDN'T BOTHER EVEN TO CHECK OR EVEN ASK THAT BANK WHETHER IT HELD CLIENT MONIES - SO NOT OUR FAULT. IT'S NOT LIKE WE INVESTIGATE THINGS OR ANYTHING.

and uncovering the scale of the alleged crime took “further digging behind what on the face of it looked like well-ordered accounts”.

WE ACCEPTED WHAT WE WERE TOLD BY THE FIRM WHICH WE WERE INVESTIGATING AND WHEN IT BECAME CLEAR ALL WAS NOT WELL, WE FAILED TO INTERVENE OR INDEED TAKE ACTION AT ALL UNTIL IT WAS WAY TOO LATE. FRANKLY, WE DON'T REALLY UNDERSTAND ACCOUNTS AND CAN EASILY BE FOBBED-OFF WITH A PLAUSIBLE EXPLANATION.

27

9

There was nothing sophisticated about it. No more than Nick Leeson 2.0 putting it at its highest. Simple trasnfer of money and a copy and paste job on the statements and bank letter.

27

18

Can someone explain this time? I’m baffled. I can well understand stealing the client account and disappearing to some sunny non-extraditing country. I can understand taking one client’s money for another and so on; but stealing a client’s money to buy another law from, which means that you will be found it in a matter of months (max a year when the audit rolls round, and probably sooner) for what? A few weeks of saying ‘I own a massive law firm’? My only speculation is that the client money was somehow dodgy (laundered) but what’s the real explanation?

23

13

‘ Uttam, whose defence states that he was “raised with the belief that it is important to be loyal to one’s brother”.’

Race card, ‘supreme master’ level.

Bulletproof.

25

17

"There was nothing sophisticated about it."

Well, I mean, it was more sophisticated than the SRA.

So, y'know, that's a kind of sophisticated.

31

13

Even if the letter from State Bank of India was genuine (which it absolutely wasn't), were the SRA not in the least suspicious that the funds had been cleared out of the actual Barclays client account in the first place, apparently for no reason and with no explanation?

Also, what kind of 'investigation' can be so easily scuppered with a hastily typed up Word document with a bank's letterhead (presumably) copied & pasted on top? This appears to be nowhere near as sophisticated or complex as our regulator would like us to believe. A couple of hours checking the firm's accounts, followed by maybe a 30 minutes skim through relevant Companies House entries and maybe a bit of Land Registry surfing, would have given them more than enough information to go on.

25

16

Astonishing ! Bet modhwadia’s ratted out his minions for a pardon….

25

14

The one certainty is that the rest of us solicitor will not be bailing this out given the SRA has a £5m cap. Before the SRA comes after us for money it should impose its cap on claims and sue everyone else to kingdom come who was at all involved.

"But at around 6.30am on 4 August, Pinsents partner Samantha Palmer asked one of her firm’s risk managers to catch a train to SBI’s Wolverhampton branch and collect original proof that the bank held the missing money, which was by then suspected of amounting to £64m." That was at least one wise moved of her but all the checks Pinsents did when it took on the client etc need to be examined very closely.

https://www.sra.org.uk/consumers/compensation-fund/resources/capping-pa…

"A cap on payments from the Fund

We can decide to limit the total payments from the Fund on connected applications to a total of £5m. This will mean that we will not pay more than £5m in total on those applications and applicants may not therefore receive the full amount they have applied for. For example, if we apply the cap in a case where there are £10m losses, we will consider how we will pay the £5m. For example, we may pay all applications a proportion of the losses incurred, or we may decide to pay a higher percentage to certain types of applicants.

This approach will allow us to assess these applications fairly and consistently and to provide all eligible applicants a reasonable level of redress while also managing the potential liability faced by the Fund.

When the cap may apply

We can consider applying the cap where:

we have received more than one application relating to the same or connected underlying circumstances

we believe that the likely payments from the Fund on those applications will exceed £5m.

24

13

Wonder if Prag Mod himself isn’t just a front for other even bigger fish?

27

13

How TF is the charlatan not behind bars already? Extraordinary.

23

13

Prags def not arrested. I was on the screaming lash with him last night at an undisclosed non-strip gents show club in Northern Cyprus last night. Some hangover today. I can confirm that he will be fighting any charges on the basis that he was entitled to the flash money from the client accounts. After all, the second syllable of his surname is 'wad.' That’s wads of wongo peeps #jackpot. However, I have to say that the heady days of London Reign appear to be behind him as he never bought his round!!!! Namaste 🙏 all

20

16

Can’t believe you didn’t go with ‘The Pragnificent Seven’.

28

14

How TF is this possible at all? The only one whose actions succeeded in that mayhem is Prags himself, that tells a lot... Shame on the SRA, I think my 2-year old kid would have done better than them!

29

13

How come no one has come up with a list of attendees in Vegas? I have only identified one external guest so far. There must have been more.

27

14

Lydia 17 November 23 10:29

The SRA are funded from solicitors - there’s no way public money ought pay for the dishonesty of a regulated professional.

I’m guessing you’re not a litigator - suing everyone to kingdom come is likely to cost solicitors far more than £500 each.

The legal sector was right to reform

And modernise - where it went wrong was massively reducing the entry criteria. When I started at the Bar, just 25 years ago, I was required to provide the name of at least two barristers who could vouch for me; ideally one was a judge. Although imperfect (and it certainly shoudnt be the only control) it is a good way of keeping the wrong sort out.

27

16

Just commenting on the statement "Following the arrests, the SRA addressed its critics by disclosing that its officers were the first to discover something was amiss, and only in July when they visited the firm to review the purchase of Ince Gordon Dadds"...

If the SRA did say that, lets hope the SRA report doesnt make it into the public domain - it might blow that (and other SRA statements) out of the water.

25

13

The SRA’s investigation of any of the big firms is always only asking them what is going on or what happened. Whatever they get told is then presented as the “outcome” of the investigation. I saw it so many times when I used to work for a city firm - we acted a lot for firms under investigation by the SRA. I am not kidding, it was a joke and it was an open secret that the SRA hated investigating and were very bad at it, often putting very junior inexperienced “investigation officers” up against senior compliance officers in firms under investigation. They and their external defence firms would run rings around the SRA. The advice to clients was always to never ever, no matter what, admit to anything which may breach the SRA principles and so long as you don’t admit, you will likely get away with it. If faced with obvious breaches, always say they are mistakes that the firm has learnt from but never ever admit dishonesty no matter how glaringly obvious it may be. The SRA are very timid and subservient when investigating, at least the big firms and the senior end of the profession (obviously it is very different when dealing with a paralegal whose firm has already abandoned them - then the SRA will go in very hard).

So I can just imagine the SRA asking the Axiom team questions, Axiom giving some answers that cover up what happened, the SRA then presenting that as it’s conclusion and apologising for disturbing.

24

13

The SRA is not being transparent.

We need a full inquiry into this.

27

16

So Prags has not been arrested and did not run off with the money to a country with no extradition treaty. The more you read about this sleazy charlatan - the more nothing makes any sense. I mean using the money to but other law firms - what did he think would happen - how did he think he would not get found out at some point??

20

11

Anyone free this evening. I’ve got a table at Novikov. Quantuma ? Same again ?

26

10

The sooner we have the names of PRAGS’ 7 alleged fraudsters the better so that other alleged co-conspirators can be collared. There must have been more than 7 taking into consideration alleged crooked bankers at Barclays & SBI not to mention auditors & others. AND why is the mastermind (joke) still at liberty? Has he turned in the 7 for immunity!!

27

10

So Prags has not been arrested and did not run off with the money to a country with no extradition treaty. The more you read about this sleazy charlatan - the more nothing makes any sense. I mean using the money to buy other law firms - what did he think would happen - how did he think he would not get found out at some point??

24

14

I don't see why the rest of the profession should prop up these crooks. The answer lays in existing, stringent regulation and the SRA actually doing its job!

23

16

How did the SRA let this happen? Will they be held accountable?

28

12

Prags end game was probably to trade out of the hole. As someone said, like Nick Leeson. The purchases of Ince and Plexus were peanuts. They would generate in one year enough revenue to plug the hole enough that no one would notice. And he could liquidate assets to place money back in when needed.

23

15

@17.16 "the SRA actually doing its job"

Ha ha ha.

24

12

Action in April would have halved losses. Will senior management still get their bonuses as I hear they did after the practising certificate renewal IT debacle?

Meanwhile - someone must have a list of who went to the party in Vegas. Please tell. I know there were outsiders there.

20

12

An issue is many think we have stringent regulation and that there is sufficient audit and regulator review requirements. Compared to other sectors (banking, insurance, investment management) that just isn’t remotely close to correct.

It’s annoying the cost of the existing failures will fall on the profession but that also normal in regulated sectors. Normally the cost is more linked to size of firm and risk, so it does seem pretty unreasonable a small firm will pay as much as large corporates given the disparity in income and risks in the work they do. Ultimately The cost will most likely double up as I expect a much tougher set of regulations to follow in due course given the press this failure will get.

18

11

Who are the oddballs down thumbing the comments? ROF’s readership used to have an irreverent but essentially sound take on issues like this. It wasn’t frequented by irritating squeaks making daft comments or exercising their right to vote like a f’wit.

The SRA leadership would be out of their depth in a puddle. They idolise the FCA and like them are superb(ish) at creating a regulatory framework and absolutely useless at enforcing it unless you’re a trainee; the legal equivalent of a toothless kitten.

Well, the tide has gone out, the professional solicitor crime of the century has been exposed and the smorgasbord of “hard to fathom who they are and WTF they’re doing there” senior SRA bods have been exposed and they are struggling to answer the same question.

Good luck getting a penny out of a single unconnected solicitor. Not a prayer.

23

11

On the Monday after Pragnesh and the other 2 were intervened, the Board of Axiom Ince said the SRA’s report was 300 pages long. No way was that prepared in a couple of weeks. No way.

23

8

When the enquiry into this takes place it needs to include why, after Plexus Law self reported and 4 Partners were sued and paid back £25,000,000 of cash/shares, the SRA ignored that report and did nothing. We know that a couple of those Partners are well connected, but that is fishy and does our Profession a disservice. Lawyers who act in ways that expose themselves to litigation in the way they run their law firms should be scrutinised.

And remember, the £25,000,000 was paid back voluntarily in an out of court settlement. They paid it back because they had to. They had to because the 2019 deal wasn’t what it was supposed to be, hence the SRA report by Plexus Law.

All of this makes it clear that the SRA is not fit for purpose. That’s exactly what 500+ Solicitors/lawyers who lost their jobs at Plexus Law think. And before you say what’s 2019 got to do with Pragnesh, look at the link and the timeline. For those 500+ lawyers 2019 was the year of that infamous and very quiet (hidden) sale to PE that lead to Pragnesh. That’s how we see it anyway. Absent 2019, 4 multi-millionaires would be a touch poorer but the firm would exist and people would have jobs and the market for insurers to shop in would be one firm larger.

Sleep well in your 4 big beds boys. Hope they are comfy. With a “I❤️SRA” bedspread.

22

8

So, the LSG says the SRA has now admitted that it sat on its hands (it may prefer "waited") for three months before sending inspectors into Axiom Ince following Axiom DWFM's purchase of the Ince Group. In other words, if it hadn't been a chocolate fireguard, it could have prevented their subsequent purchase of Plexus and saved numerous jobs.

17

5

But why did it take a FOI request before the SRA became more transparent?

And there’s still much more to come out with respect to what the SRA knew and what it did.

An independent inquiry is required if the profession is going to have to cough up to cover the cost of all of this.

We can then decide what we do about the SRA.

17

6

To ex employees- are there any group legal actions being considered against the auditors, law firms and the State Bank of India?

21

6

"Sue the lot". As I understand it, the auditor was a small practice and probably has a low limit on its cover, law firms might have the cover but could have a reasonable defence and the bar must be very high to fix any liability on the Bank. However all the directors in post at the time of the cash disappearances ought to be seriously worried, not least because the SRA will be looking for scapegoats to excuse their own shortcomings.

20

8

Indeed.

It would surprise me if the SRA are currently sat in a brain storming session about how to shift the blame.

And it’ll only be a few minutes until someone breaks the silence by saying ‘… could we blame the trainees? I know it’s our normal game plan, but would that work?’

22

5

The SRA are sitting on multiple reports of fraud and theft at the moment, some of which were submitted months ago. Those lawyers are still at large and currently practising.

20

4

Rumours abound that someone in the accounts team raised a red flag internally but was shut down

18

5

The down and upthumbing is not working on this thread. I noticed thé down thumbing a bit irregular. Orages? SRA is that you?

17

5

A little boy enters a sweet shop with lots of bank notes and starts pointing at every sweet jar, ordering the shop keeper to fill bags with sweets from every jar.

The shopkeeper didn’t want to intervene. It would complicate matters if the shopkeeper were to ask where the money had come from. He was just happy to sell the sweets without asking any awkward questions which might lead to him having to decline the sale, even though he’d heard some things about the boy taking money from his mother’s purse.

The shopkeeper didn’t want the aggravation of challenging the boy or calling up his mother. He preferred a quiet life and simply crossed his fingers and hoped that there would be no repercussions for him if it turned out the boy was a thief who had raided his mother’s purse.

Later that day the boy’s father arrived and asked the shopkeeper why he hadn’t suspected anything, why he’d sold the sweets, why he hadn’t questioned where the money had come from and whether he’d heard anything about the boy taking money previously from his mother’s purse.

The shopkeeper explained he didn’t intervene because it would have cost him time and money to do so and he was just glad to make a sale.

Everybody blamed the shopkeeper and viewed him as inept and irresponsible but he didn’t care because his was the only sweet shop for miles and it would all soon be forgotten by the villagers as they got on with their busy lives.

17

5

We still have West End law firms acting for dodgy offshore vehicles with impunity. I'm note sure we have a prison big enough for all the "wealth advisors" in London laundering corrupt money.

14

5

Maybe someone needs to look into the acquisitions prior to ince and plexus- all the partners/ directors from other acquisitions were paid significant sums- those should be repaid if the money originated from the client account.

15

5

I was one of the Plexus Partner's who was corralled (some would say bullied but not me) by Pinsent Mason into selling to Axiom even though there were other bidders. They didnt act for the Partners and had sole control over the decision making. They did due diligence that they werent prepared to share. They are then instructed by Prags to act for him when the net was closing in? did they also act for the administrators for Ince in its sale to Axiom (my money is yes). There are some serious questions to answer about a) their relationship with Prags; b) their independence and whether there was a conflict of interest c) their competence

Perhaps worst still was their arrogance and attitude to the Plexus Partners, which at the time didn't feel good but now is particularly not a good look